This is an efficient way to optimize your cash flow in a fluctuating financial environment. In low interest rate times where returns on cash are difficult to come by, treasurers and financial executives can generate tremendous returns with this solution. In high interest rate environments this program can be a lifeline to critical vendors who are important to smooth running supply chains.

It’s cost-effective for both your company and your vendors. You get a discount on selected goods and services along with a better return on your cash and your vendors get access to cash quicker and at rates lower than traditional factoring. Utilizing our vendor portal or supplier portal platform, dynamic discounting provides 24×7 visibility into early payment offers that suppliers can choose to accept or reject. ICG can automate your accounts payable process (AP Automation) so that invoices are approved and through the system quickly and become candidates for dynamic discounting. And all of your financial data and transactions are secure! ICG, along with it’s partners Amazon Web Services (AWS) and Sysdig, provides around the clock security, monitoring, and detection and response.

What is Dynamic Discounting?

Dynamic Discounting is a program set up by the buying company that establishes a process by which buyers (customers) and sellers (suppliers) can alter the standard terms of payment “on the fly” in a highly dynamic, flexible, real-time environment.

You now have a voluntary system where the buyer offers the vendor an early payment discount. This approach is a big shift from the normal supplier discount paradigm where vendors offer the buying company fairly static discount terms on a “take it, or leave it” basis.

Dynamic Discounting is an efficient way to optimize cash flow in a highly dynamic, real-time environment.

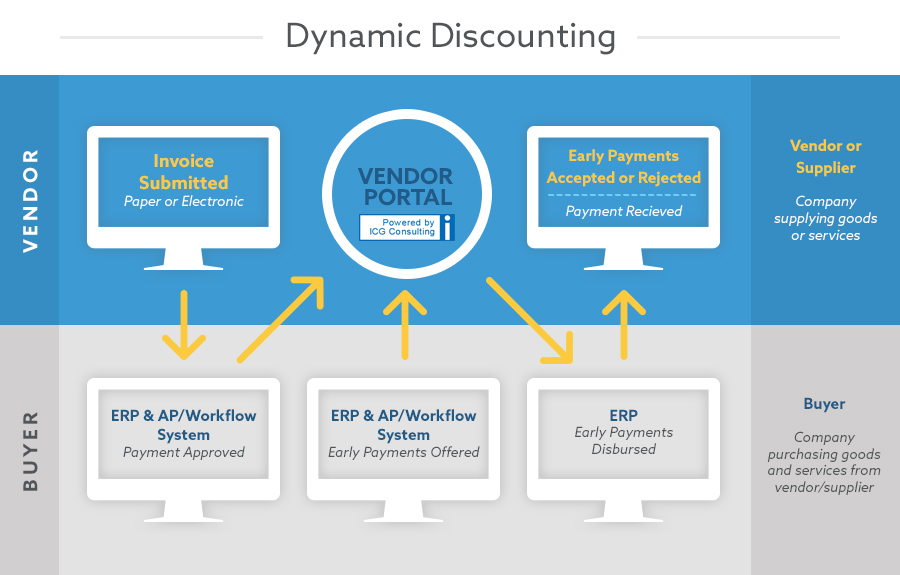

For instance, the buying company can offer a significantly higher discount for paying some or all invoices many days before the due date and a smaller discount for paying invoices as the payable ages closer to the standard due date. Based on the cash needs, borrowing costs, and other factors for the vendor they may choose some invoices for early payment while allowing others to go through their normal payment processes. The dynamic discounting process happens within ICG’s vendor portal:

- Supplier submits invoice for payment

- Payment status appears in vendor portal or supplier portal

- Buyer offers discount for early payment on selected invoices

- Supplier views and accepts early payment offers via the vendor portal

- Vendor portal notifies buyer of acceptance of early payment terms

- Buyer pays within 24 hours via electronic payment

Benefits of ICG’s Dynamic Discounting Solution

With Dynamic Discounting, the savings to the buying company can be tremendous and the benefits to the vendor encourage a high level of participation.

It also enables you, the buying organization, to offer targeted suppliers early payments in exchange for discounts on the payables due at a later date. These programs are a win-win for both the buyer and suppliers.

- Buyers can save millions of dollars by taking advantage of paying less for goods and services through an aggressive discounting program. The dollars invested in a dynamic discounting program generate a sizeable ROI, generally much higher than other short term returns on cash.

- Suppliers can optimize their cash flow, reduce high borrowing costs and have predictability in the payment cycles.

Achieve savings of 1/10th of 1% to 3/10th of 1% of annual spend, or $1 million to $3 million for every $1 billion in spend. System designed to allow you to control: % of discount; amount of cash dedicated to program on a daily, weekly or monthly basis; which suppliers, invoices, product or service categories are eligible to participate.

The dynamic nature of this program means the amount of cash, discount percentages, and invoices discounts offered on can be changed to fit your current cash strategy and to maximize the return on your short term cash investment. For instance, the discount offered can be changed as the cash flow position of the buyer changes. Additionally, the percentage of the discount can decrease as the transaction becomes closer to the normal payment date.

Who Can Benefit from Creating a Dynamic Discounting Program?

According to PayStream Advisors, “buyers who report achieving these discounts tend to pay their suppliers about 10 to 15 days before the invoice is due.” Since dynamic discounting allows for both the buyer and the vendor to maximize cash flow and generate savings, all parties gain significant financial benefits. The buying company also benefits by helping key vendors in their supply chains to remain healthy and financially solvent.

A few things to consider before implementing a dynamic discounting program:

- “Have we implemented an effective Accounts Payable Automation process so invoices are approved for payment in a timely manner?”

- “Do our vendors have a vendor portal and use electronic invoicing?”

- “Does our workflow management software support dynamic discounting?”

Dynamic discounting is worth a look for every business that manages a significant number of invoices each month, but you must have efficient AP processes in place before implementing a dynamic discounting program. Some of our clients have justified upgrading to electronic payment processes for the sole financial benefit of implementing a dynamic discounting program.

Since it’s important to have automated Accounts Payable processes in place before launching a dynamic discounting program, the first step may be implementing a comprehensive vendor payments or AP automation solution with a corresponding vendor portal. Every business has unique needs, so schedule a demo today or request more information on any of ICG’s business process solutions.

Also, take a look at ICG Consulting’s other complimentary cloud hosted solutions such as AP Automation, Vendor Portal (Supplier Portal), Vendor Onboarding (Supplier Onboarding), Workflow, ERP Integration, Data Capture & Document Assembly, PO Dispatch & Update to name a few.

Contact ICG Consulting today to speak with a representative or schedule a free demo.

You can also watch a short video on ICG’s comprehensive solutions Solutions Video.